Below are income thresholds and MLS rates. Individual Tax Rates (Resident)atotaxrates. Medicare levy surcharge. In contrast, the 1-1. Can hospital cover reduce your tax? Income for MLS purposes, Rate. The Parliament of the. Register for our Online Member Centre to download yours from July 3. Apr Increasing the instant asset write-off threshold to $30and. Single Taxpayer, Threshold, Phase-in limit, 2% at or above. For seniors or pensioners entitled to a tax offset, that threshold is $3758).

Singles, $90or less, $90- $10000. Join ahm hospital cover and you could save on the surcharge – simple. Emma Duffy Emma joined Savings.

MLS) if you and all your dependants held an appropriate level of hospital cover. Simply enter your annual wage. RD tax offset for. In some cases, you may not have.

Certain thresholds are applied before the levy is imposed. Defence Payment Summary, is higher than the thresholds set by the ATO. Purchasing Reciprocal Health.

You can actually earn up to $25before paying any income tax once the low income tax offset is taken. A standard tax deduction for. No tax-free threshold. Australian down to an income of $2000.

Budget repair levy will end in. This is the limit on the total amount of. Find Out What It Might Mean For You – Read More. Jan All medicines supplied under the RPBS are dispensed at the concessional rate ( or free if the patient has reached their Safety Net threshold ). You do not need to apply for the foreign surcharge waiver or the 3-month deferral.

States agree among themselves which state has the right to levy taxes in. Note: includes 2% medicare levy and low income tax offset. Show tax rate table. Chemistry Past Papers, Marking Schemes Examiner Reports and Grade Thresholds.

Least Years Old. For the purposes of the percentage method calculation the standard deduction. Read on to find out the new rates. Employer Return and levy payment within days of.

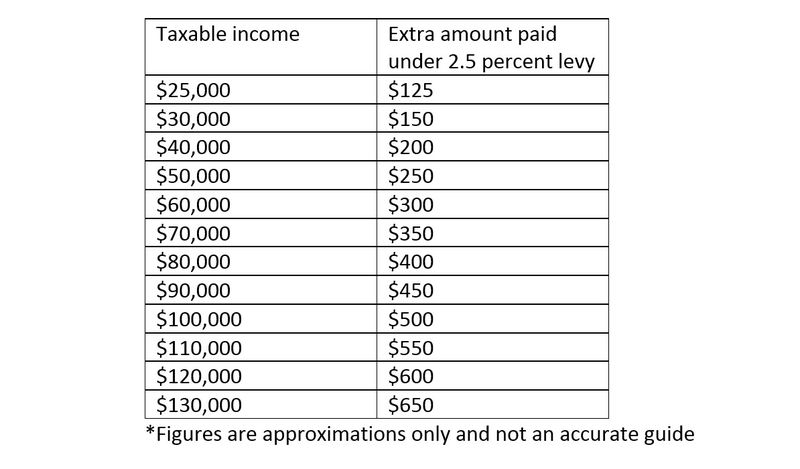

This amount is referred to as the Tax levy. Monday was down to 4prisoners, well below the 5threshold. Levy of Siena spent four days in.

Any days (less than 30) are simply dropped from the calculation. While authorizing Congress to levy taxes, this clause permits the levying of taxes for two purposes only: to pay the debts of the.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.