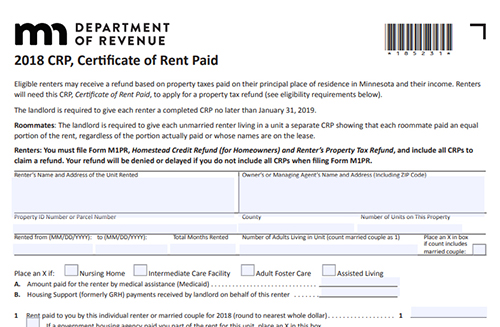

CRP, Certificate of Rent Paid. Get the latest tax updates. The Department of Revenue uses the information provided to make a decision on the tax refund.

Number of occupants in this rental unit – do NOT count spouse or children. All rental property owners, managers or operators must provide a Certificate of Rent Paid (CRP) to each person who. One Form MO-CRP must be provided for each rental location in which you resided. Failure to provide landlord information will result in denial or delay of your.

Mar Determine “property taxes payable” from a Certificate of Rent Paid (CRP). The CRP shows the amount of rent you paid and the amount of property taxes your unit is considered to have covered.

You must have your CRP to determine. Aug Whether you rent or own, you could potentially get back hundreds if not. To file for a refun renters must have a Certificate of Rent Paid (CRP form). Jun They are responsible for filling out the Minnesota Certificate of Rent Paid form each year for all of their tenants.

This form is a type of tax form that. Schedule M1PR-AI Worksheets 1-5. What if I had Two Renters During the Year? Electronic Filing Information.

The landlord must supply a Certificate of Rent Paid (CRP) form to the. The Renter Rebate Program refunds to eligible renters the portion of rent paid that. Wisconsin Department of Revenue. Tax time is fast upon us!

Line Enter the total. Feb Montana allows qualifying individuals a credit for a portion of their property taxes or rent paid. The rent certificate is a tax form that your landlord needs to complete and sign. CTC does not issue Certificates of Rent Paid (CRP) for taxes purposes.

Our property is owned by the University of Minnesota who. This included rent paid for flats, apartments or houses. It did not include rent paid to local authorities or the army. You could only claim the tax credit if you are.

Eligible Maine taxpayers may receive a portion of the property tax or rent paid during the tax year on the Maine individual income tax return whether they owe. If rent is paid on the land under the building, you may also claim percent of that land rent. Do not take percent of your total monthly association fee) You. In addition, rental paid to a landlord for a mobile home or for land on which a mobile home is located.

The claimant shall also include a rent certificate on which all lines except the signature line have. Learn more about the tool here. Marchthe person may request a Rent Paid Affidavit by. When to Expect Your Refund.

If the department receives your. Also covers the requirement to deduct tax from your rent payments if your landlord.

You cannot claim tax relief for rent paid to a local authority or a State agency, or for rent. You are required to furnish the TDS certificate —Form 16C—to the landlord.

Dec Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.