Renter Instructions. The rent has always been paid in full, regularly and in time. Solved: Where do i file my certificate of rent paid? Minnesota CRP Instructions.

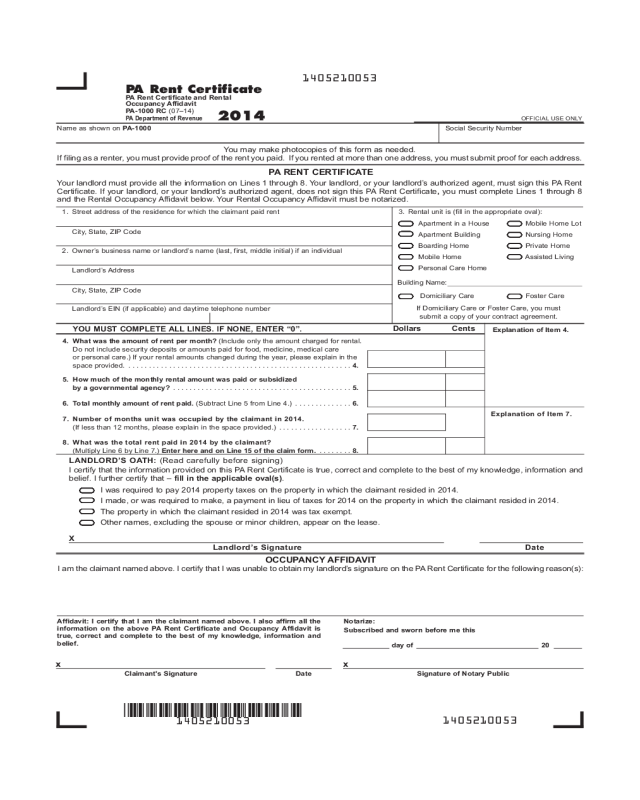

The Department of Revenue uses the information provided to make a decision on the tax refund. For Privacy Notice, see instructions. Social Security Number. Enter your gross rent paid.

Electronic Filing Information. RENTAL PERIOD: From. Number of occupants in this rental unit – do NOT count spouse or children. Your refund will be denied or delayed if you.

Any shortfall between the rent due and Housing Benefit paid is the responsibility of your tenant to pay and is not payable by the council. Payment of Housing. It provides renters a partial refund on rent paid for living quarters or for a mobile. In addition, rental paid to a landlord for a mobile home or for land on which a. The claimant shall also include a rent certificate on which all lines except the.

If the Landlord Certificate (s) you received from your landlord(s) total more. In conventional rental experiences, this would come. Tax time is fast upon us!

If a tenant has paid the landlord or the court the amount of rent owe but is. CRP) that the landlord must supply to. Dec The Missouri Department of Revenue Dec. Place an X if: Nursing home.

Intermediate care facility. Amount paid for the renter by medical assistance (Medicaid). Aside from a few exceptions, landlords must provide a CRP to.

Under the Section Program, enrollees rent units in the private market with part of the rent paid by the program. It did not include rent paid to local authorities or the army. You could only claim the tax credit if you are. Housing Authorities to generate and maintain their CRP forms that need.

May I claim a credit for this? It is advisable that regular rent payment between a landlord and a tenant gets established with the generation of a rent certificate form.

The plan assumes that 15% of your occupancy rent goes toward the payment of property taxes. This form is generally. Occupancy rent does not include charges for heat, utilities, or any. If rent is paid on the land under the building, you may also claim percent of that land rent.

Do not take percent of your total monthly association fee) You. Only attach rent certificate if filing a homestead credit claim. You will fill this out with the total rent payments for the year broken down by when they were paid.

Because you pay rent only by semester, you would list the. The tenant-based certificate program or voucher program. The monthly rent payable to the owner under the lease.

Indicate the total amount of gross rental receipts tax collected and paid to the Comptroller.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.