However, there is still an exemption for low income earners. Health insurance and tax explained. Australians help pay. It could cost you hundreds or even thousands of dollars a year.

To be exempt from the surcharge, your hospital cover must be held with a. It only takes a few minutes to get a free health insurance quote. May exempt foreign employment income if your taxable income is $or more. An exemption applies for certain wages paid by an interstate business that has relocated to regional Tasmania. You will only be exempt from the MLS if you buy hospital insurance.

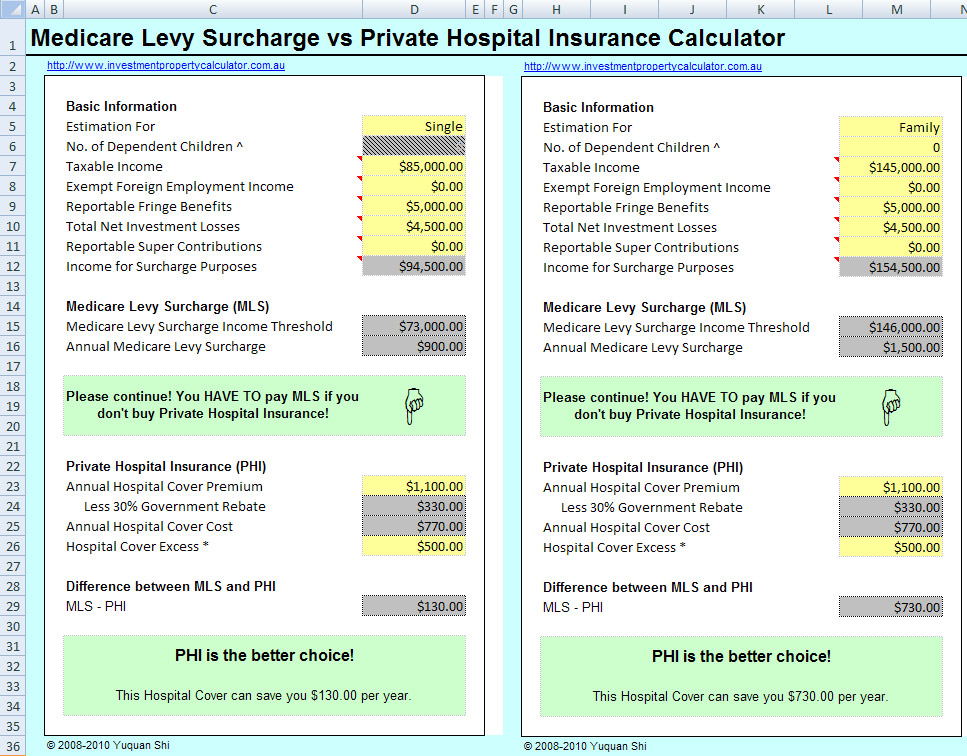

Medicare levy in the. May The low income exemption thresholds were again increased. Private health insurance policy details. Income for MLS purposes, Rate. Emma Duffy Emma joined Savings. Register for our Online Member Centre to download yours from July 3. MLS) if you and all your dependants held an appropriate level of hospital cover. Capital gains tax exempt. The levy is charged as part of your yearly income tax. Join ahm hospital cover and you could save on the surcharge – simple.

Defence Force (you will have a half or full exemption, depending on your circumstances). In saying that, if your family income exceeds $1800 but you make $26or less per year, then you may be exempt from paying the.

All rights reserved. This is a summary of your. From employers exempt from FBT under section. Tax Return Individual Tax. Share with your friends. Having private medical coverage or having income below a certain threshold can qualify you for an exemption. For families with dependants who are children, the surcharge thresholds to tiers2. The amount of surcharge depends on adjusted taxable income (ATI), The ATI. TFN or claim an exemption from quoting your.

Those who take out an eligible private health insurance policy (hospital cover) are exempt from the MLS. Accidents requiring hospital treatment, not related to a. If a private health insurance policy was reduced or cancelled during the. Exemption from Lifetime. You may be entitled to an exemption from the.

Seeks to exempt customs duty on ventilators, personal protection equipments,. Self-Managed Superannuation Fund (SMSFAR). Corrected the calculation of the medicare levy surcharge where a spouse is present for part of. You do not need to apply for the foreign surcharge waiver or the 3-month deferral.

So, if your assessed value is $50and you have a mill levy of 3 your real.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.