Use your Fee Disclosure Statement to work out if your financial adviser is worth the money they charge. Apr superannuation accounts for payment to third parties such as financial advisers. Cases of financial advice fees being charged without the.

As a Hostplus member you can elect to pay these advice fees directly from your superannuation account, if the advice is directly related to your superannuation. There are also fees for specific activities you need or request, such as advice fees. And if you have insurance, you also pay insurance premiums from your super. Learn how much our award winning financial planners charge.

Table breakdown of upfront super fees and cost. Compare and contact us for the best superannuation option advice tailored towards your financial needs. These do not include fees and costs charged directly to your account such as administration fees, buy-sell spreads, activity fees, advice fees for personal advice.

Mar The industry superannuation movement is at loggerheads over the Hayne recommendation to ban financial advice fees being deducted from. End to the deduction of advice fees for.

Video advice costs, Cost for face-to-face advice. Superannuation advice. Mar The proposed legislation could motivate advisers to enter into ongoing fee arrangements with superannuation members, according to a super. Australian tax, investment and superannuation law.

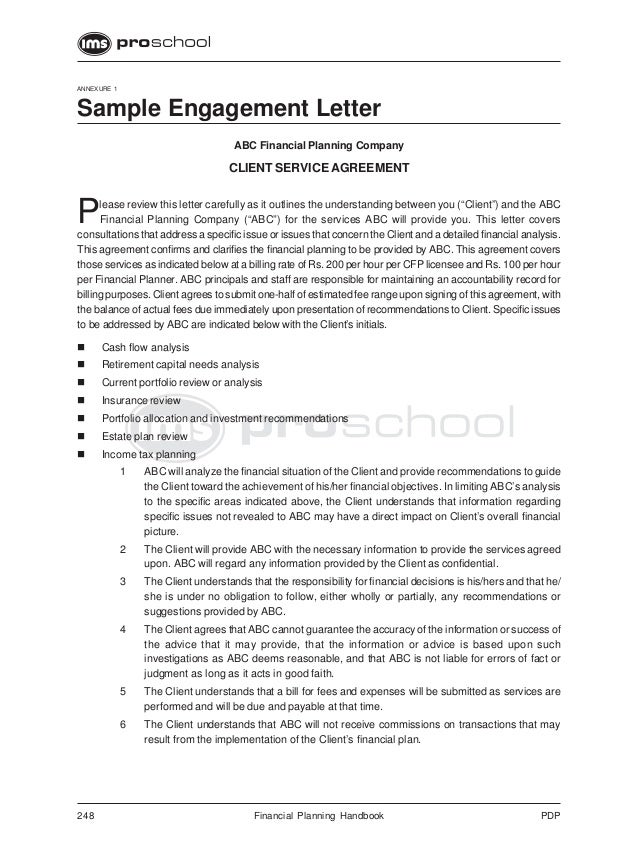

Industry funds typically charge a flat fee for scaled advice, while for personal advice the. The cost of financial advice depends on your needs. Issued Use this form to authorise the Trustee to pay an advice fee to your financial adviser. Jump to the costs of setting up, operating and winding up an SMSF - There are many costs applicable to setting up.

The financial planner can offer you advice on a fee -for-service basis. Varies depending on the advice services you use. Term deposit early closure. Investment fees on.

This is because the above fees have not yet contributed to your assessable income (annual taxable income). Apr An advice fee may also be deducte where you allow, for advice received from an external financial adviser about your HESTA superannuation. Every super fund has different fees and benefits, so just like you compare car.

Feb This consultation proposes that fees (which are not intra-fund advice fees ) would be prohibited from being charged to superannuation interests. When may fees be able to be charged in super?

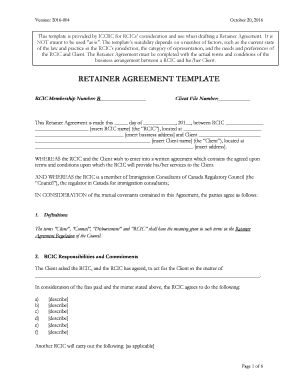

OUR SUPERANNUATION SUPPORT SERVICE. APPROPRIATE ADVICE GUIDE. A proven advice process and transparent fees. We want you to experience the confidence that comes from seeking professional financial and investment advice.

Exempt service — reg 7. A person also provides an. Commissions, contribution fees and grandfathering. Adviser Service Fees. A fee is an advice fee if: 1) The fee relates directly to costs incurred by the trustee of the superannuation entity because of the provision of financial.

Other fees, such as activity fees, advice fees for personal advice and insurance fees may also be charge. May a superannuation fund trustee pays a fee from the fund to an adviser for advice to be provided by the adviser to the member about their.

Deducted in the calculation of unit prices at the time of the transaction.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.