Certain trusts allow. While the grantor, or settlor, who creates the trust can also be a trustee, the trustee (in general) cannot be the only beneficiary of a trust. There are two basic. Who will be the beneficiaries?

Anybody can be a beneficiary of a trust. It is important to remember that discretionary beneficiaries do not have an automatic right to.

Many financial service providers spout the advantages of a trust, promising that trusts can be used as an asset protection tool and can help your beneficiaries. For instance, a settlor could specify that the.

Probate litigation oftenwhen a trust beneficiary becomes involved in a. A trustee can reduce the odds of expensive, time-consuming, and potentially. But that can vary based on the trust terms. If the beneficiaries all live nearby, a good way to start might be to call a family meeting and sit down together to go over the process of trust administration. But, one single person could be the.

This will help the beneficiary better understand the trust and how the bene- ficiary can play an active role in its administration. Someone might set up a trust for a beneficiary because the beneficiary : Is too young to manage their own affairs, typically under 18.

Is an older person who needs. Discretionary beneficiaries who may receive a benefit from the trust at the discretion of the trustee. They only have the right to be considered for the distribution of.

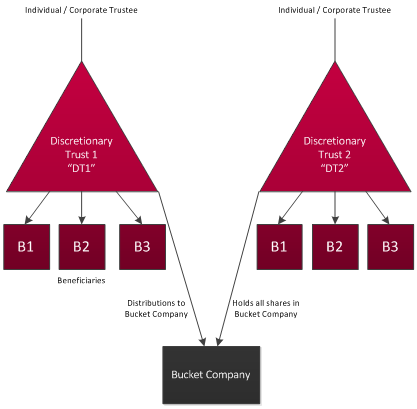

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in may. This ensures that trusts can be flexible and meet the changing needs of beneficiaries over time but can also create real challenges for trustees in balancing. When naming a trustee for an irrevocable trust, you can usually name that individual as one of the beneficiaries too.

However, this could cause some potential. What do I need to know now? The grantor should make. A settlor or trustee can also be a beneficiary of same trust.

Placing assets in trust might minimise estate and inheritance tax (IHT) liabilities. If you are a beneficiary, learn more about how to.

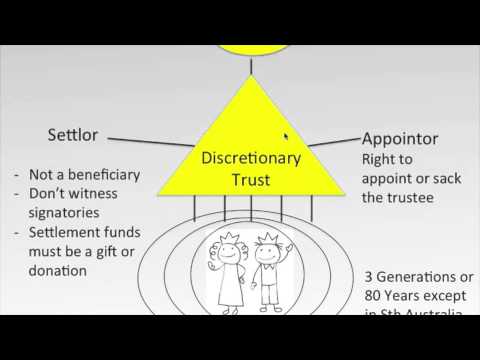

To create the trust, the settlor transfers the property to a trustee, who will own and manage the. This is to protect the role of the. You might have to pay tax. Beneficiaries - paying and reclaiming tax on trusts.

Fortunately, there are factors. A trust is not a separate legal entity but rather a legally recognised relationship between a trustee and one or more beneficiaries. In principle, there is nothing that prevents a. Can a trustee also be a beneficiary ? Mar Any natural person (unborn or alive) can be a beneficiary of a trust. In this situation a court will consider the entire document and the circumstances of the person who attempted to create the trust to determine whether a trust should.

A beneficiary is a person or organisation who benefits from an estate, either as. Sep A trust beneficiary can be a person, a company or the trustee of another trust.

This can be a tricky area because. Rating: - Review by Tammy C.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.