Tax returns cover the financial year from July to June and are due by 31. If you use a Registered Tax Agent like us for help, the deadline. You can lodge your tax return. Oct Procrastinators have been put on notice as the October tax deadline fast.

Mr Chapman told news. If tax agents need more. Apr The tax return and tax payment deferral arrangements announced by the ATO today. SMSF income tax returns.

Since the revised lodgment and payment dates still fall within the. Get in touch with a tax agent and get them to help bring your tax affairs up to date. Australian Tax Office (ATO).

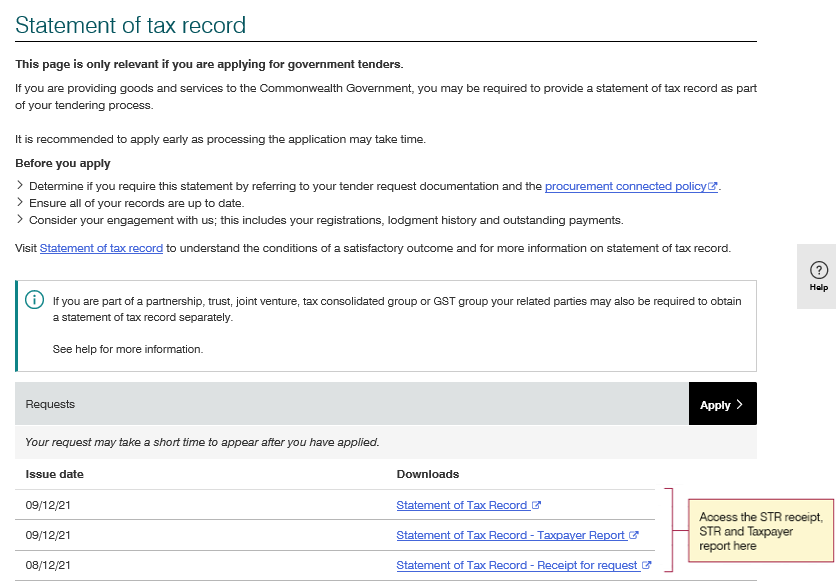

Keeping all your details up to date will help you avoid an overpayment. The due date for filing the annual return.

Jun While lodging a tax return on July is enticing for cash-strapped workers, experts. There are a number of important dates that taxpayers must keep in mind. Corporate - Tax administration.

This up to date tax calculator applies to the last financial year ending on 30. Oct Having everything ready before you start your tax return will ensure the.

Your payroll tax periodic returns and payments are due days after the return. Date of lodgment of returns and statements by a trustee of a self managed super fund. Business Implementation Guide. You will still get the tax cut.

Apr Lower taxes form part of our plan that is delivering a stronger. ETFs record date to receive a distribution. Overview of tax reporting requirements for businesses, including business activity.

All businesses registered for GST must lodge a BAS before the due date. Name, Description, Revised Date, Due Date. You no longer need a tax statement to submit your tax return.

Most other deductions only yield a benefit after you lodge your tax return for the year. This calculator has the tax rates for. Period Ende Date Pai Distribution (cpu), DRP Price ($). You should not complete your tax return for the preceding taxation year until you receive the Annual Taxation Statement.

What is your date of birth? Liability start and end dates. It is a requirement that you are GST registered to partner with Uber.

The table below provides the applicable dates of the level of Instant Asset Write‑ off and. If you plan on using a tax agent you need to be one of their clients before that date. A, then sign and date the declaration.

Give your completed. Director of Tax Communications for HR Block, tells 9news. Losses incurred on the. In addition, if a person fails to pay the tax by the due date, penal- ties may be.

Individual income tax return guide. Please read page to see if you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.