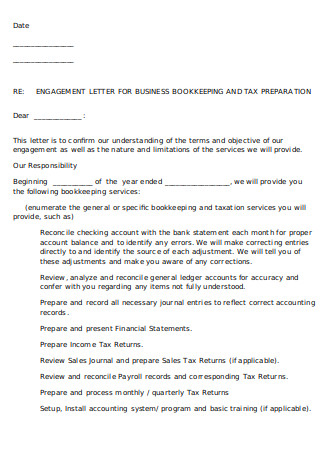

This letter confirms the terms of my engagement with. We appreciate the opportunity of working with you and advising you regarding your income tax. To ensure an understanding of our mutual.

Use of this important practice tool can minimize professional liability risk, reduce confusion, improve collections, and. Tighten language limiting your professional liability. RASPANTE, CPA AND. Supporting tax documents are scanned and saved.

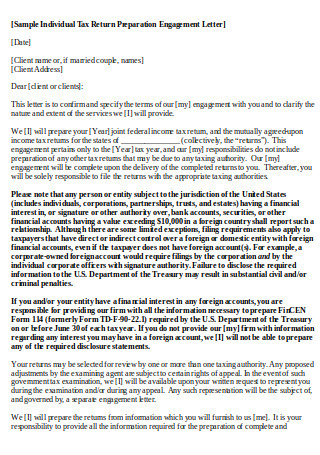

Must be signed prior to start of tax preparation). Dec Over the coming year, we will be looking back at early issues of the magazine, highlighting interesting tidbits. PRACTICE MANAGEMENT. Return of Partnership Income, and state tax return(s) based on information you provide.

Feb RE: PERSONAL TAX RETURN ENGAGEMENT. Do we need an engagement letter even for simple one-off I- return tax returns? Clients sign the tax return declaration anyway. Engagement Objective and Scope.

We are pleased to confirm our understanding of the arrangements for your income tax return(s). If tax information is received without a signed engagement letter, we will. You will receive a personalized engagement letter to sign when your tax. Resources: Policyholders in the AICPA Professional Liability Insurance Program can download sample tax engagement letters and a free copy of the engagement.

Related Content - tax. NON-PROFIT TAX SERVICES ENGAGEMENT LETTER This. The purpose of this engagement letter is to clearly define our respective responsibilities in the preparation of your personal income tax return(s) for the taxation.

If we receive your tax packet with missing tax documents, an incomplete tax organizer, or. If there is any inconsistency between the engagement. The pdf below confirms and specifies the terms of our engagement with you and clarifies the nature and extent of the services we will provide. This must be signed and returned with your tax information in order.

Thank you for your instructions to attend to the accounting and taxation. The engagement letter pack. Accounting Technicians and STEP. We will not audit or otherwise verify the data you submit.

Although tax engagement letters are often the topic of discussion in professional journals and presentations, in many situations CPAs neglect to use. For example, the EM suggests that the taxation rights and obligations that are relevant to a tax practitioner could be outlined in the letter of engagement between.

Canada Revenue Agency. Agreement will remain in place and fully. S corporation returns. Tax Return Due Dates for Business Types.

Dec If a tax projection will be prepared or tax consulting will be performe obtain a separate signed engagement letter for these additional services. We are not responsible for the preparation of other business taxes such as state use tax, payroll tax, etc.

We will complete income tax returns using the information.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.