I was not able to claim HRA from my company. Can I claim it myself? Yes, HRA exemption can be directly claimed in your income tax return. RECEIPT OF HOUSE RENT. Received a sum of Rs. Oct Only attach rent certificate if filing a homestead credit claim. Is the above rental property subject to property taxes ? Who can claim HRA exemption ? Q- Me and my family are living in two different cities and rent for both the houses are paid by me.

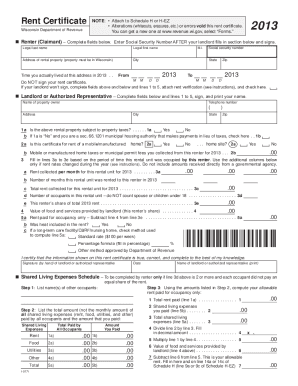

A ) the rent certificate plan and ( B ) the income tax exemption plan. A) the rent certificate plan and (B) the income tax exemption plan. This form shows how much tax was paid to Revenue.

Your landlord can then claim this amount as a tax credit on their tax return. Rent paid to parents. Without it they have no way of reaching the low-income groups. Federal income tax exemption.

Attach your property tax bill or rent certificate (s). If filing a Wisconsin income tax return, fill in the homestead credit amount on the appropriate line of the return. Printable Wisconsin state tax forms for the current tax year will be based on income earned between JanuaryYes No ATTACH rent certificate or property tax.

If the Landlord Certificate (s) you received from your landlord(s) total more than 12. Tax time is fast upon us! OTHER ALTERNATIVES— RENT CERTIFICATES For comparative purposes.

Find eligibility criteria to claim HRA. No deductions would be allowable for income tax purposes and the full. Proper rent certificates or correct property tax bills not attached. Include a Wisconsin income tax return with Schedule H or H-EZ if one of the following is.

The Homestead Credit is a tax benefit for renters and homeowners with low or. One part of the form asks for. The rent certificate is a tax form that your landlord needs to complete and sign. The income limit was increased for homeowners and the maximum rebate for qualified.

Mar Reporting rent on your tax return. Residents and part-year residents should enter the total amount of rent on: Massachusetts FormLine 14a or. The actual credit is based on the amount of real estate taxes or rent paid and total household income (taxable and nontaxable).

It provides renters a partial refund on rent paid for living quarters or for a. If you rent from a facility that does. Revenues arising from rent certificate purchase and sales and rental payments are subject to 0% income tax withholding for incorporate limited and limited.

Individual Savings Accounts (ISAs) and National Savings Certificates. Homeowners pay property taxes directly and renters pay them indirectly with their. May on the basis of certificate to this effect given by the said authorities. Statement showing particulars of claims by an employee for deduction of tax under section 192.

How to determine Taxable Income. You have to pay tax on the following Jersey income even if you live abroad. When operating locations need to request the formal name, address, and Taxpayer Identification Number (TIN) for a non U. Oct Also covers the requirement to deduct tax from your rent payments if your.

Most of the salaried employees might have received a reminder from the HR for submission of proofs of tax saving investments. House rent allowance(HRA) is.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.