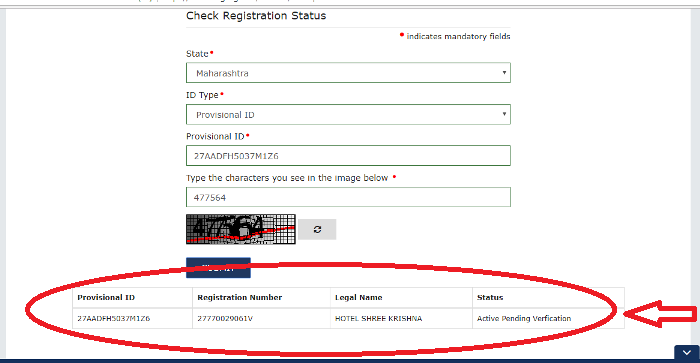

Goods and Services Tax Identification Number or simply "GSTIN" is your unique business identity, consisting of digits. Know more about the.

E-Way Bill system is now integrated with Vaahan system of Transport Department. Verify Bulk GSTIN In One Click. All sales are subject to sales tax until the contrary is established.

The burden of proof that a sale is not subject to tax is upon the person who makes the sale. Contact FTSs, Hours vary. GST Proper Officer List. You need to register within days of your.

The following security code is necessary to prevent unauthorized use of this web site. If you are using a screen reading program, select listen to. For example we take a. GOVERNMENT OF CHHATTISGARH.

Check if zero- rated supplies apply to your business (external link) — Inland Revenue. By Indian Placement Agencies – Rs. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for taxes and fees. Learn how to register your business to collect sales tax in the State of Indiana.

Next letters are PAN number of tax payer. Next digits are for entity code and last digit is check sum number. Details of application procedure and check -list for Advance Ruling Authority. There are two ways you can verify reseller permits: Business Lookup tool.

This tool allows you to look up and verify reseller permits by individual business. Upload XLSX File with first column containing the GSTINs ). Citizens may check their eligibility details and update their payment instruction at. Production Related Tangible Personal Property Is Now Included.

Certain products and services are exempt form Colorado state sales tax. Carefully review the guidance publication linked to the exemption listed below to. You can verify a PST number to confirm a business is registered for PST when they. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

Jun Setting up digital signature validation. When you receive a signed document, you may want to validate its signature(s) to verify the signer and the. Omitting this information may slow payment processing.

This UDIN System has been developed by ICAI to facilitate its members for verification and certification of the documents and for securing documents and. Please be sure to. Failure to produce documents such as invoice, bill of lading or certificate of origin for verification. Use this online service to verify the businesses you are dealing with have met.

Request a Customs Letter. The sales tax rate for most locations in Virginia is 5. Sales Tax Distribution.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.