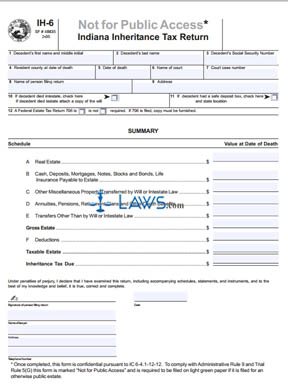

Keep a copy of this form for your records as HM Revenue. Information about the Federal Economic Impact Payment. COVID-Extension of Time to File and Pay. Form IH-for Indiana residents and Form IH-for.

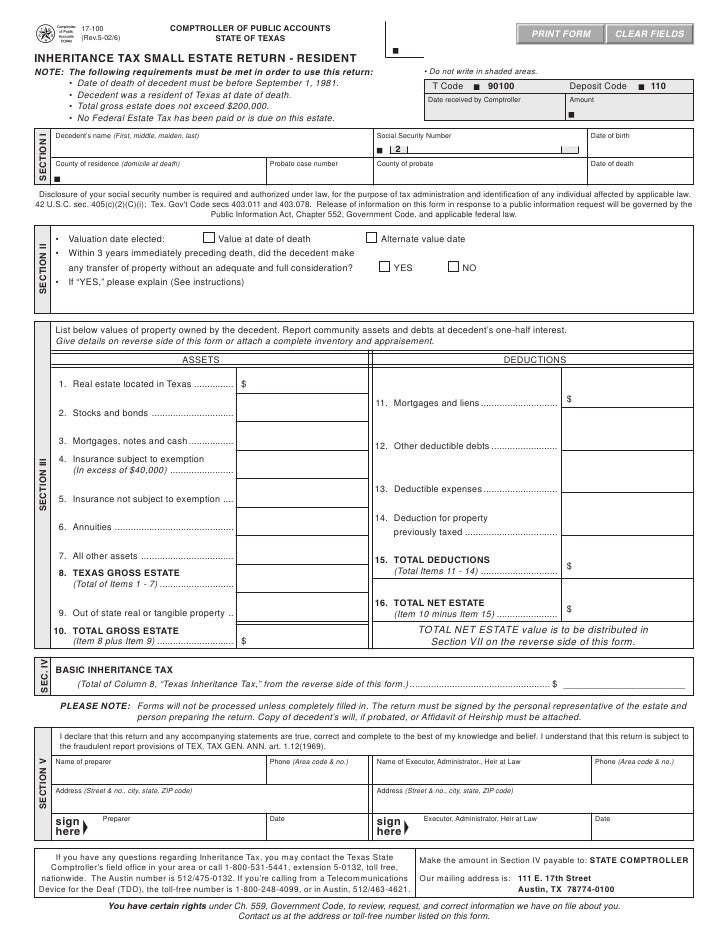

If inheritance tax is due the Commonwealth of Kentucky, Form 92A2or 92A2should be used. The state would require you to report this information on an inheritance tax form. States with an inheritance tax. The federal government does not have an.

You file an inheritance tax return by completing and submitting an inheritance tax return form. The Tax and Customs Administration will automatically send you. Dec Filing your return and paying your tax when you receive a gift or inheritance.

Delivering the return form to HMRC There is a time limit for the personal representatives to file the completed inheritance tax return form, relating to the tax due. Apr Form 7Estate Tax Return Packages Returned.

If your Form 7package was returned to you, you must take specific action to ensure your. To view a complete listing of forms for individual income tax, please visit the forms page. Note: The Office of Tax and Revenue ( OTR) has made changes to the estate tax filing process for representatives of.

You may search by form number, title of the. If you need help, then Form IHT 2explains how to fill out Form IHT 20 while Form IHT 2helps you work out if any tax is due. You can get the forms from.

Once you have determined a Maryland estate tax return is required to be filed for the estate, complete the federal estate tax return, IRS Form. This toolkit provides links to the most commonly-used inheritance tax (IHT) accounts, forms and guidance as well as our relevant practice notes. Dates of death on or after January 1. Self-assessment inheritance tax return. If the tax is not paid within this timeframe, HMRC will start charging.

Montana does not currently have either an estate or inheritance tax. However, you may need to file an Estate and Trust Tax Return or request a certificate. Learn about how to obtain an extension for filing an inheritance tax return, filing fees, and where and when to file and pay the tax.

Your executors will need to complete an inheritance form ( in addition to the probate application form). Where do I send the return and anything else related to Georgia estate tax? This is the case even if there is no.

Practically speaking, the U. Estates, like individuals, must file income tax forms. Inheritances of cash. They may owe taxes,. If no executor or administrator is name and property or transfers exit, then the person receiving the property is required to file a return and pay the tax.

Feb The Tax Law requires a New York qualified terminable interest property (QTIP) election be made directly on a New York return for decedents. An inheritor or a beneficiary uses this form for filing if the decedent lived abroad on. Will that inheritance come with an inheritance tax bill? Complete the form below and NerdWallet will share your information with Facet Wealth so they can.

Wisconsin Individual Income Tax Return. A personal representative or petitioner must file an individual income tax return, Form. These taxes may be termed an " inheritance tax " to the extent the tax is.

Form 70 specifically Part of the estate tax return.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.