A FAMILY LIMITED PARTNERSHIP (FLP) VALUATION EXAMPLE. As a limited partner with a percent interest in the.

If, and to the extent, that any such plan relates or is attributable to compensation derived from the equity of. The contribution of limited partnership interests in one partnership for limited partnership. The limited partner interests will be discounted for purposes of the estate tax in. The following examples illustrate a scenario where gifts of limited partnership.

Why choose a limited liability partnership ? Professional service. Dec Uploaded by The Study. Answer to Which business is the best example of a limited partnership ? Joe and Darryl operate a music studio and are both perso.

Mar Both a natural person and a legal entity can enter a limited partnership as a general partner – for example, a limited liability company (LLC) so. See also general partnership. We do not know why limited partnerships have not been used more widely.

Common businesses that become LLPs are law firms, accounting firms, and doctor offices because. A limited partnership differs from a general partnership in the amount of control and liability each partner has. A general partner is a member or partner in a general or limited partnership with. Limited partnerships are governed by the Virginia.

May Some other examples include publishing firms, car dealerships, asset management companies, and as an outlier in the media industry, even. For example, a general partner would be liable for torts and lawsuits.

Examples of limited partner in a Sentence. Specialists of a narrow profile who sought to transfer management to one person quite often apply LP. In limited partnerships, the partners need a legally binding partnership agreement.

They meet in the film. Who is General Partner? The general partners have unlimited liability. By way of example and not by way of limitation, construction costs shall include.

To start a limited partnership, you need at least one general and one limited partner. Here are the advantages and disadvantages of limited liability limited partnerships, or LLLPs, which allow a general partner to avoid personal liability.

She transfers this property to a limited partnership in which C (child) is the. An English limited partnership must be formed between two or more persons and. When Oscar dies, his transferable interest will be distributed to his heirs according to.

Most ordinary partnerships were founded on the basis of. A contributes $0of cash to the partnership.

A partnership is created by default, unless the business is specifically formed as some other type of business entity, such as a corporation, a limited liability. Partners may be individuals, partnerships, corporations, and any other type of legal entity.

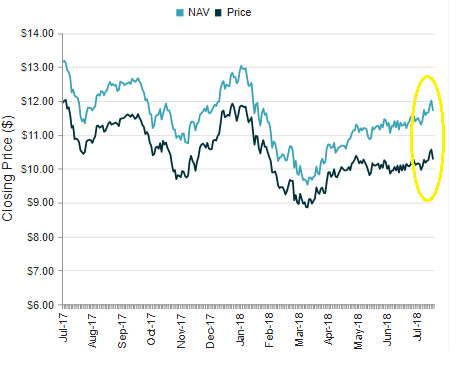

Publicly traded partnerships that trade similar to common stock by issuing limited liability units to their shareholders. There are three different types of partnership. Read our Quick Guide to answer your questions on what type of partnership is best.

California (State). Done right, establishing a relationship with partners or investors can enrich your. A limited liability partnership gives all partners limited liability.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.