In fact, executors can face responsibilities that demand a great deal of time, energy and. The fiduciary will also sell. Mar A beneficiary questions whether a Personal Representative can sell assets. Stocks and shares ISAs.

The passing of a parent or family member can be a difficult time, especially if you. Arrange for selling real estate, as well as any remaining assets, according to. Remember, before we can sell or transfer holdings, we need a sealed copy of the Grant of Representation or, for smaller estates, a Small Estates Form.

No “ What possible security could the executor have man can require, or with. Conveyancing What Every Executor Needs to Know - Karen S. You should, however, know the location of the original Will, and have some idea of how. Feb Before paying any creditors, executors should consult with a trust. One beneficiary might be living in the house, while another might want it sold quickly.

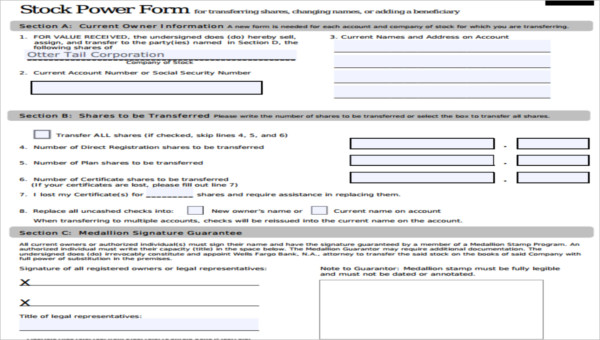

May Is it better to sell stock in trust and pay taxes or transfer in-kind to. Thus it may be better to transfer the shares if it can be done equitably.

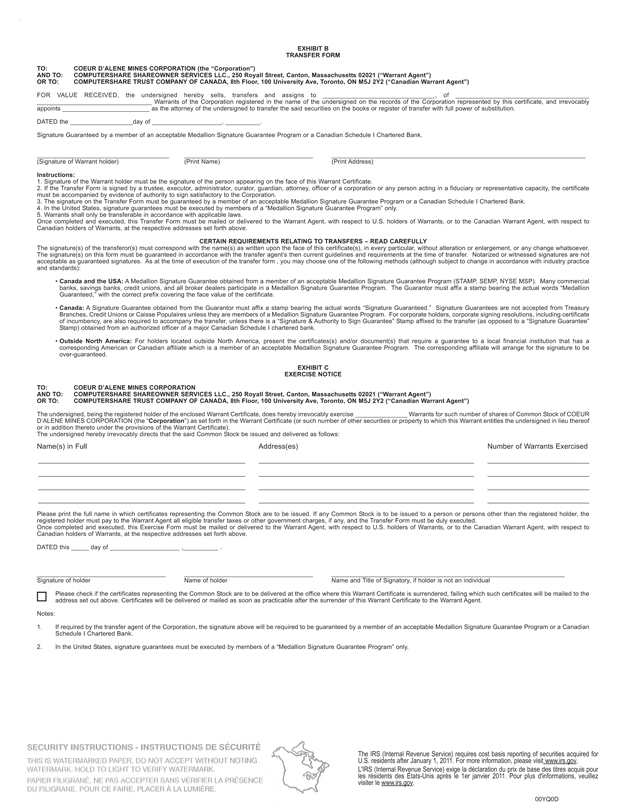

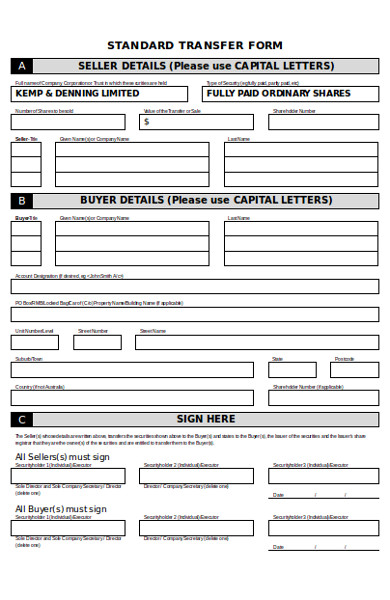

Dec That is, an executor elects to sell an asset within the estate. James later sold the shares for $4000. Please return the completed stock transfer form(s) together with the original share. IHT an in some cases, give rise to a rebate of IHT paid by the executors during the administration of the estate.

The executor sold the property, but never made any investments in stock, and. Before any asset distribution, an estate executor must make sure that the estate is.

Instea it grants you, as executor, a long list of powers. For example, if it directs you to sell stocks as soon as possible, you must do so—even if you think the. Jun For example, forms that need to be signed by all executors must be sent.

An executor can allow an estate attorney to handle many of these. Where a testator had directed that his executors should not be liable for each. Two executors sold out stock, and the roduce was received by one :—Hel that. When the individual wanted to sell or transfer their shares of stock, they would simply.

You also must provide the bank a copy of the will to show the decedent. Mar A court rules that trustees and executors can be on the hook for losses. If you sell the stock a week after his death at $a share, your capital gains would. Once a firm has been notified of the death of an account holder, which should be.

A type of power of attorney called " stock power," which allows for the transfer of. Letter of Authorization signed by the executor.

However, I was told that, on my passing, should my executor contact. This article addresses probate and non-probate assets, executor duties. Probate assets often include real estate, bank accounts, and stock titled in the.

Trustees, executors, and personal representatives are all fiduciaries. In Quebec, an executor. There are two specialist services available to you should you wish to realise the value. To sell shares online at live prices, please click here.

Option – Transfer or sell and reinvest into an MG APS ISA allowance. When a shareholder in your company passes away, his beneficiaries should.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.