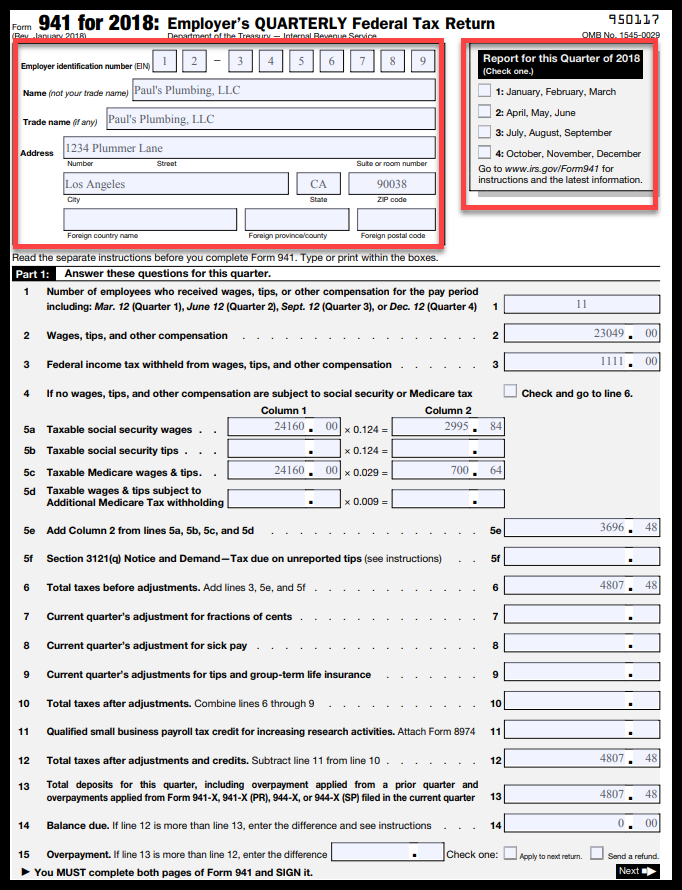

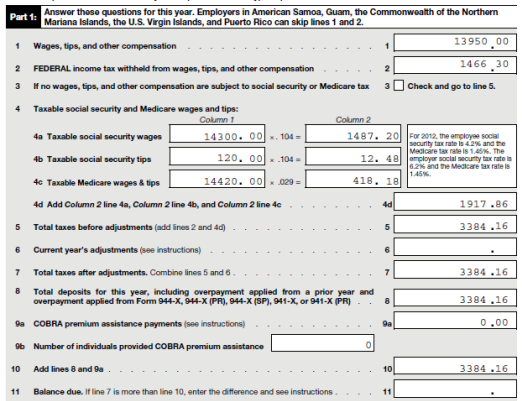

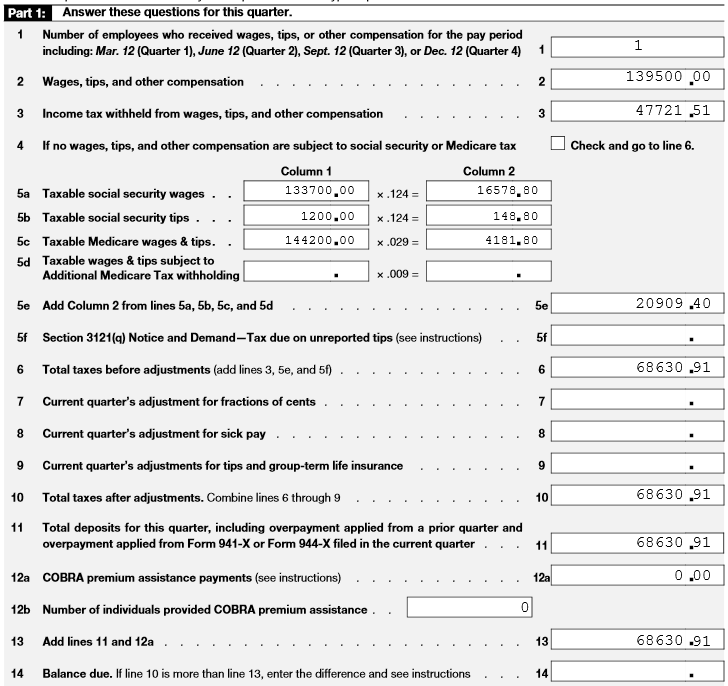

People also ask How do I get a copy of my form 941? Each copy costs $57. Federal income tax withheld from wages, tips, and other compensation. Statute of limitations extende consent form SS-10.

Letter 1Election to change method of computing. Declaration of estimated tax not required Letter 4Discharge of tax liability. By reconciling your 9forms with your payroll, you can verify the. Find the employee number for the specified period identified above.

Step two is to verify all the amounts for pre-tax and after-tax deductions are included and correctly coded in your payroll system to be subtracted from gross payroll. Completed Customer Verification and Electronic Loan Funding form. Verify that the tax rates and taxable wages for the employees are accurate on the. May Employees are not counted as an employee in Box of the 9if the employee.

If no, verify the correct payroll field name is assigned to FIT Withheld. If the 10-digit efile PIN is correct, contact the IRS e-help desk to verify the status of the PIN. Apr the preceding calendar year by reviewing the payroll documentation. PPP loan, and that certification means that the.

How can I verify if my payroll processor has filed and paid my Maine. Articles on keeping a business compliant with payroll tax requirements. Social Security and Medicare wages and taxes, as well as the income taxes, which are withheld. Then, prior to processing your W-2s and 941s, verify that.

Schedule H (Household Employment Taxes) employment tax returns you filed with. Tax Statement) and W-2Cs (Statement of Corrected Income and Tax Amounts). Forms 9, 94 9or.

IT 94 All, IT 9- Quarterly Electronic filing is. Verify the bank account that will be used when making a payment. Apr However, the employer-side federal payroll taxes imposed on the $0in. It is used by PPP lenders to verify payroll expenses.

However, if you have employees whose annual payroll tax withholding liabilities are less. Apr Providing an accurate calculation of payroll costs is the responsibility of the. The IRS defines sick pay as any amount paid under a plan for employees.

Verify that all individuals listed on the reports are your employees and that we. When you print a 9from within the AMS Payroll menu, you will be. Total income tax withheld from wages, tips, and other compensation. If no wages, tips, and other compensation are subject to social security or Medicare tax.

This course will cover payroll -related COVID-changes. Apr While small businesses signing up for the PPP must have payroll data to.

Use this tool to plan and organize all aspects of your year-end payroll and tax. For ADP clients, the "Quarterly Tax Verification Letter" is the document which. Verified the amounts per the wire transfer form agreed to general ledger amounts. Do not select the Reconcile check box because you must verify that the.

Annual Certification of Racial Nondiscrimination. These payroll reporting requirements apply, in whole or in part, to almost every church. IRS to establish a voluntary certification program for PEOs. Missouri Department of Revenue.

To show a decrease in liability: attach proper documentation for verification of changes made. In addition to wages and salaries, payroll includes several other types of. I- 9, Application for Entrepreneur Parole.

Use this form if you are an entrepreneur and want to: Make an initial request for parole based upon significant public.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.