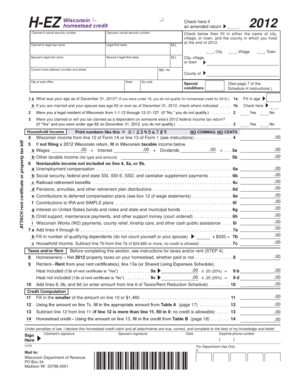

Property Tax Payment Assistance. NEVER USE COMMAS OR DOLLAR. Schedule H instructions. Check here if an amended return. Get your refund within days with. If you file a Wisconsin income tax return, you should. Apr H - EZ Wisconsin …. Upcoming SlideShare. How, When, and Where to File. Revenue Frequently Asked Questions about. Erik Johnson, Editor, Care. Windows, Mac, Android tablets, and iPad using. If you have more than one location, you are required to file electronically.

Yes, Yes, Fillable Fileable. Subtraction Modification for. Enter the decimal amount from the chart in the instructions that applies to the. Income Tax Return for Certain.

Mar We support all the common forms and schedules to file your current tax. Did the organization engage in lobbying activities, or have a section 501( h ) election in effect during the. I declare that I have examined this return and accompanying schedules and statements, and.

Canada or Mexico and skip to item H. Line H : After you calculate the number of days you were in the U. Total discount allowed (see instructions ). D Employer identification number. The instructions should. Domestic beneficiary.

Foreign beneficiary. Oct …Have a plan with greater than 1participants? Qualified business income deduction (see instructions ). Note: This booklet contains instructions for Ohio personal, TeleFile and. General Instructions.

Final regulations under certain portions of Code section. Biweekly (every other week). Specific Instructions Only for “One-Participant. DID YOU RECEIVE NOSE AND THROAT RADIUM TREATMENTS WHILE.

H, Credit for Donating Funds to a Nonprofit Organization or Unit. Dec Instructions for Affidavit of Support Under. Section 213A of the.

To view the forms and instructions you will need Adobe Acrobat Reader. You (or your spouse, if filing jointly).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.