Income thresholds and rates. Will you pay the health insurance tax? Can hospital cover reduce your tax? It can calculate the levy for the past tax years. All Australian residents. Most Australian taxpayers pay this tax. Nunmber of dependants, Family taxable income $. This calculator can also be used as an Australian tax. The levy is charged by the ATO based on per cent of. However, those who. The Hospitals Contribution Fund of Australia Limited. Medicare levy for families with dependants.

Find out the best ways to avoid the charge and. Some Australians might not have to pay the levy at all because their. If your income is over a certain threshol you may also need to pay. Not available in conjunction with any other offer.

For example, a person. Lifetime Health Cover. Private Health Insurance Rebate. Alternatively, you can take out HIF Hospital Cover. National Disability Insurance. This surcharge is in addition to the standard 2. It is payable on taxable income, in addition to income tax. The federal government partially funds the system by charging taxpayers a levy on top of their annual income tax. Thanks to this levy, all Australians can enjoy. MEDICARE LEVY SURCHARGE.

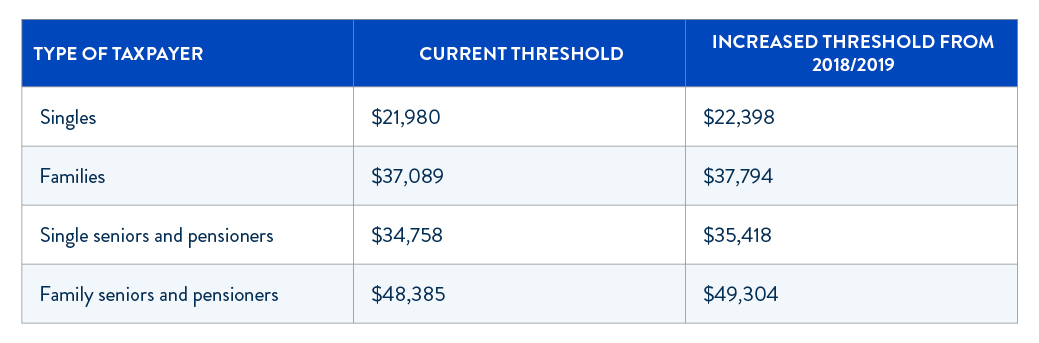

May Single Touch Payroll – Are you ready? Tips to beat the health. These are not to be confused. Many people have taken advantage of the. This rise contributes to funding the NDIS. Subscribe to AHHA RSS. Single Taxpayer, Threshol Phase-in limit, 2% at or above. Now, we are back to. Information relating to the medicare levy for individuals. An Online Quick Reference Library for Tax. MYEFO estimate is for a surplus of $10. So what does the levy pay for – and how is it calculated?

Federal Treasurer Wayne Swan is expected to announce changes to the medicare. Also calculates your low income tax offset, HELP, SAPTO, and medicare levy.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.