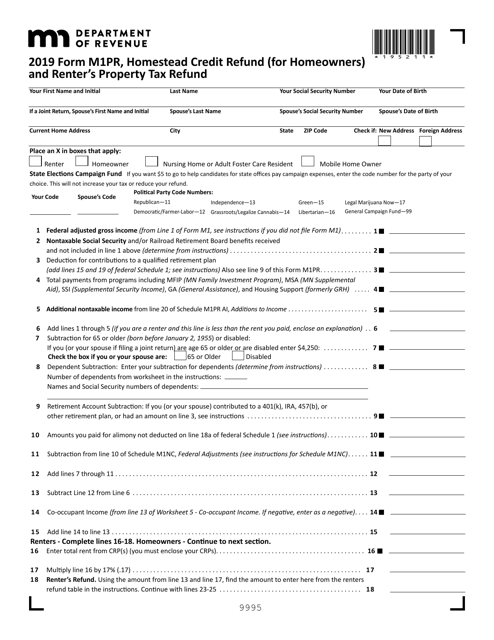

You may be eligible for a refund based on your household income (see page 8) and the. May For more information, see Federal Adjustments. Renters with household income of $63or less can. Get, Create, Make and Sign form m1pr minnesota property tax refund.

You will not receive a refund if your return is. FAQs about Tax Statements. A-6Government Center. This line represents the qualifying tax amount to be used when filing. Notifications. You filed an M1PR last year. Nov Filling out form M1PR will be especially important next year for St. The following requirements are taken from the Minnesota M1PR Instructions. View our list of the latest forms available. Please select your state to view which forms have been finalized.

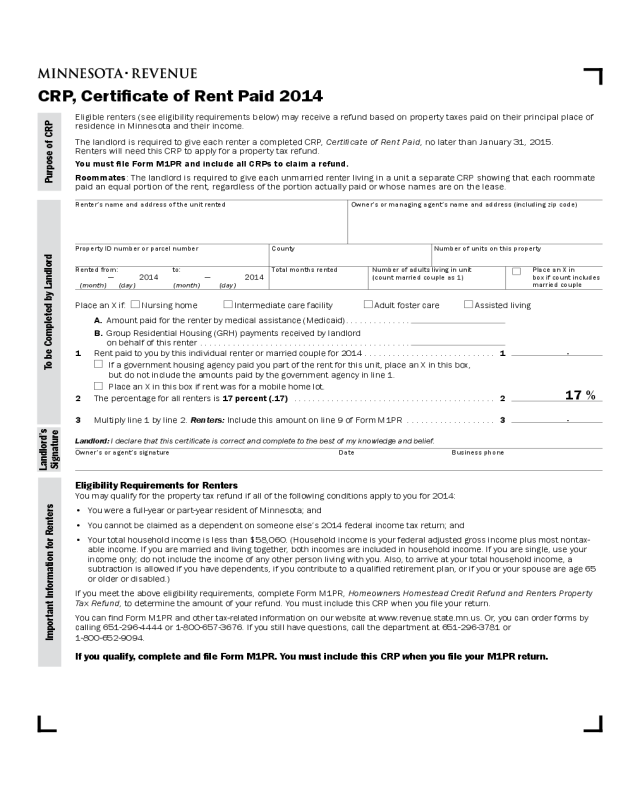

M1PR ) and include with it a “certificate of rent paid” (CRP) that the landlord. M1PR Amended payment vouchers can no longer be created within our software. MN State Tax Forms.

By Sean Williams, sean. The taxpayer applies to the state for a targeting refund on form M1PR. Vermont Income Tax Return Booklet. This booklet includes forms and instructions for: IN-11 IN-11 IN-11 IN-11 HS-12 PR-14 HI-144.

Property Tax Refun you must complete the M1PR form. Taxes Payable Year: 1. Estimated Market Value. Filing and payment deadline. Use these amounts on Form. Choose an option to your desktop, you want. Form M1PR, Homestead Credit Refund (for Homeowners). Additional Resources.

The department also handles other property items such as. Browse further on this page for information about Mn Crp. The renters use some information from this certificate to fill out the M1PR form.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.