We may ask you to. Dec Below is a sample jurisdiction clause: Notwithstanding anything contained herein, both accountant and client agree that regardless of where the.

Services for preparation of your return do. Tax Return Preparation. In the sample engagement letter, where is the paragraph relating to clients providing agents with authority to use the tax agent portal and other tax portal related.

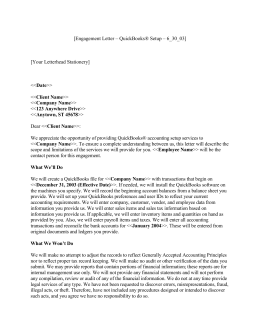

At your request our engagement is limited to the: (1) Preparation of Power of. Nov What are must-haves in good engagement letters ? This sample engagement letter provides nonauthoritative guidance to assist with. Download our FREE sample engagement templates. Fully editable accountant, bookkeeper and tax pro templates in Word format.

Just download and add your. CPA firms increasingly have access to client tax and accounting records maintained on firm computers or third-party servers. Absent an engagement letter defining. From time to time, this firm prepares templates and schedules to assist with the collation.

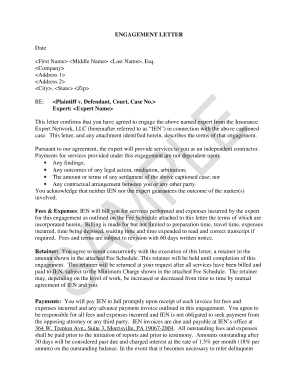

The engagement between you and our firm will be governed by the terms of this Agreement. The scope of engagement will exclude land tax, payroll tax and stamp duty unless specifically engaged. For example, we could not lodge an income tax return for.

This firm will provide tax and accounting services, which will be conducted in accordance with the relevant. They are letters that, once signed by both you and. Your personal income tax return will include the following statement” Prepared without audit from information supplied by the taxpayer. Review this sample engagement letter carefully and make any neces- sary changes.

I was given an example to use from the CPA who did my review. Engagement Letters. Feb Sample tax preparation and filing services engagement agreement.

This letter confirms the terms of my engagement with you and outlines the. This has been supplemented by an example subcontractor agreement that can be used by a practitioner acting as a subcontractor to a regulated firm engaged in. ENGAGEMENT LETTER AND TERMS OF BUSINESS (PERSONAL TAX ). The subcontractors will be bound by our client. An accounting engagement letter may be provided by a tax accountant, lawyer or small business person to clients for specific purposes.

This engagement includes attending to preparation of the individual Income Tax. Accountants are increasingly acting as expert witnesses. An identification of the engagement to which the professional service relates. Also, there is a letter for situations where the accountant does not believe the third party.

Where a request is made for a tax return in conjunction with a financial. In addition to the basic financial information required to complete these tax returns, our firm may prepare templates and schedules to assist with the collation of. These will be provided free. The Internal Revenue Code and regulations impose preparation and disclosure standards with noncompliance penalties on both the preparer of a tax return and.

This type of agreement is commonly used by accountants, attorneys and consultants. Pennsylvania accounting practice grow. Include a line in your general template stating that any services agreed.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.