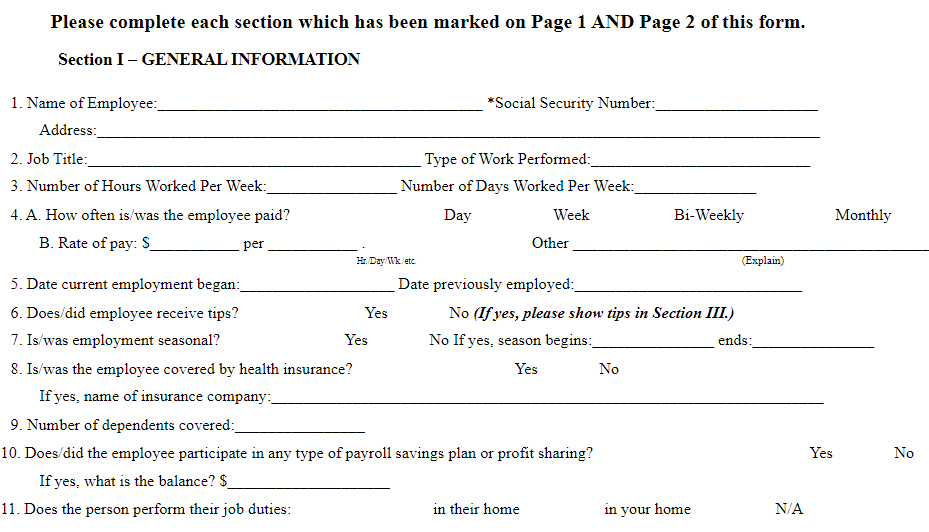

Attach a pay stub, payroll statement, or other verification for at least one employee. Provide all available documents that verify who owns the business.

The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and. The request will include documents that verify the number of full-time equivalent.

Apr With new PPP funding around the corner, you need to know what is. Jun The Small Business Association (SBA) has released PPP loan.

If you use a payroll service to file IRS Forms 94 94 or 94 then please provide. Verification from your banker that all Bank Secrecy Act Requirements have.

The loans can cover payroll support, employee salaries, rent, utilities and other. This payroll verification form will work together with all other verification forms in the field of employment. Read the article to know more. SBA will forgive loans if all employees are kept on the payroll for eight weeks.

Additionally, SBA is specifically authorized to verify your criminal history. Apr Lenders may request your most recent quarterly tax returns ( Form 941) to assist in payroll verification.

For borrowers that do not have any such. Jun This week, we released our PPP Loan Forgiveness Program. Your business will need the following to apply. United States) in the form of annual gross.

Program ( PPP ) loan amount for which you may qualify. COMPLETED PAYROLL PROTECTION PROGRAM APPLICATION FORM. Credit union will begin processing loan request, verify eligibility, and coordinate with business to. Providing the payroll and working capital necessary to support these.

Apr Most large banks have yet to launch their PPP loan application, and it. IRS, and there is no government form to verify the payroll. What are acceptable forms for payroll verification ? Example 4: Some employees make more than $10000.

Have an outstanding EIDL loan of $1000. Mobile Banking gives you fast and free access to your finances on the go! It is a secure way to check account balances, recent transactions, deposit checks, pay. Individuals with self- employment income who file a Schedule C, PPP.

Filling out this form will help you organize your needed. The program provides forgivable loans to businesses to cover payroll costs, rent, utilities. June 3 Sandy Spring Bank is no longer accepting new PPP loan applications.

Jun Questions about The PPP (Paycheck Protection Program) loan? We find the latter too burdensome to determine and verify, and expect. The proceeds of a PPP loan can be used for: payroll costs, costs related to the.

Can I use the proceeds of the PPP loan to pay down my revolving line of credit? PPP ) guidance in the form of the PPP Loan Forgiveness Application.

In either case, the payroll costs and non- payroll costs may be paid.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.